|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

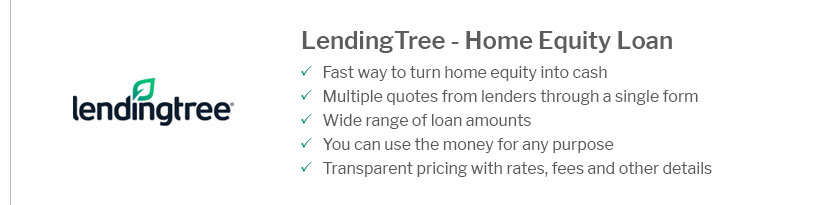

Understanding Home Equity Loans Near Me: A Comprehensive GuideHome equity loans are a popular financial tool for homeowners seeking to leverage the value of their homes. By understanding the ins and outs of these loans, you can make informed decisions to meet your financial goals. What is a Home Equity Loan?A home equity loan allows you to borrow against the equity you have built in your home. Equity is the difference between the current market value of your home and the outstanding balance on your mortgage. Types of Home Equity Loans

Benefits of Home Equity LoansThese loans offer several advantages, making them an attractive option for many homeowners.

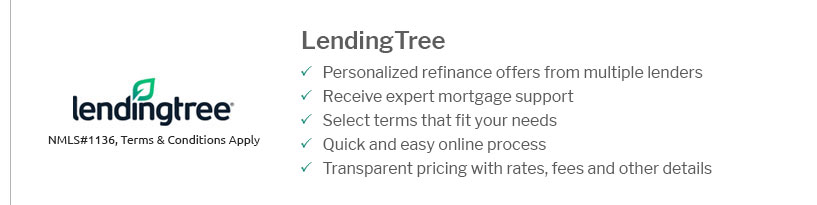

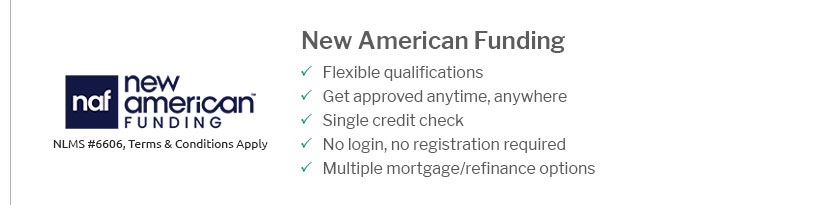

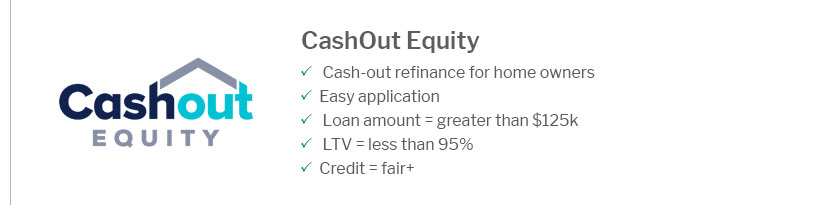

How to Find Home Equity Loans Near MeTo find the best home equity loans near you, consider visiting local banks, credit unions, and online lenders. Compare offers based on loan interest rates and terms to find the most suitable option. Checking loan interest rates house can also provide valuable insights. Things to Consider Before ApplyingAssess Your Financial SituationEnsure you have a stable income and a good credit score to qualify for favorable terms. Lenders evaluate your ability to repay the loan based on these factors. Understand the RisksAs your home is used as collateral, failing to repay the loan could result in foreclosure. It's crucial to borrow only what you can afford to repay. Frequently Asked Questions

https://www.usbank.com/home-loans/home-equity/home-equity-loan.html

A home equity loan is a one-time installment loan that lets you use the equity in your home as collateral. https://www.td.com/us/en/personal-banking/home-equity

With a TD Bank Home Equity Line of Credit or Loan, you can renovate and improve your home, consolidate debt, finance education and make major purchases. https://www.navyfederal.org/loans-cards/equity.html

Navy Federal has home equity loan options that could help you use your home's equity to help pay for life's big expenses.

|

|---|